Featured

Table of Contents

- – What is the Advantage of Level Term Life Insur...

- – The Ultimate Guide: What is Level Term Life In...

- – Everything You Need to Know About 30-year Lev...

- – What Makes What Is A Level Term Life Insuranc...

- – Is What Is A Level Term Life Insurance Polic...

- – Why You Should Consider Term Life Insurance ...

If George is detected with a terminal health problem throughout the very first plan term, he probably will not be qualified to renew the policy when it ends. Some plans offer guaranteed re-insurability (without proof of insurability), but such functions come with a greater cost. There are numerous kinds of term life insurance policy.

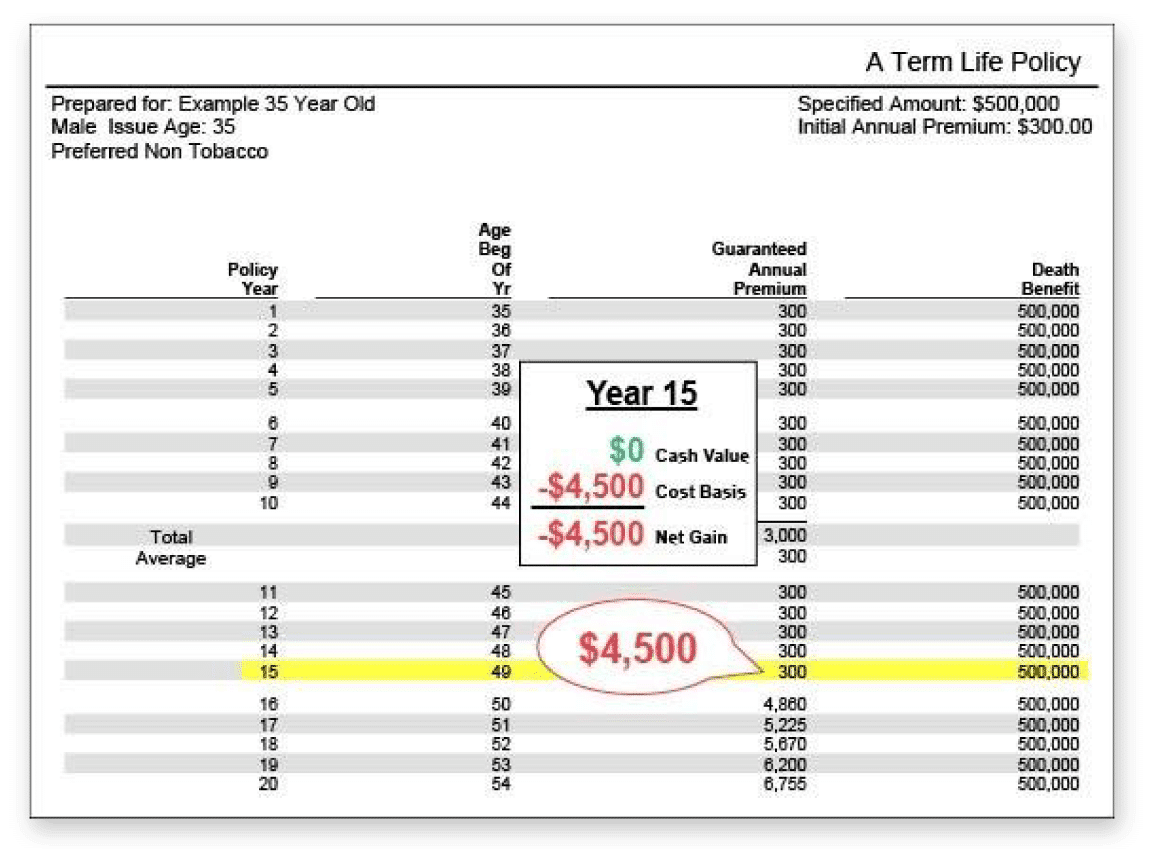

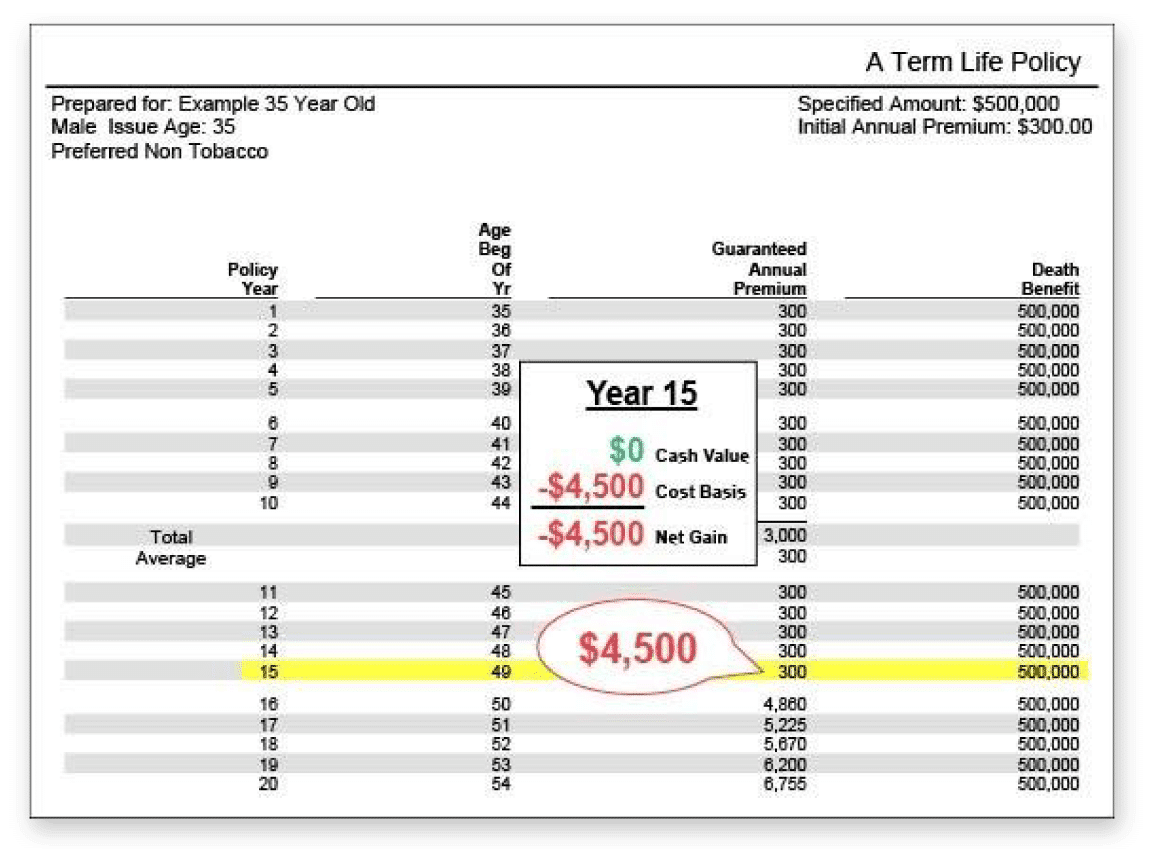

Generally, most business supply terms varying from 10 to three decades, although a couple of deal 35- and 40-year terms. Level-premium insurance policy has a set month-to-month settlement for the life of the plan. A lot of term life insurance policy has a level premium, and it's the type we've been describing in most of this write-up.

Term life insurance policy is attractive to youngsters with youngsters. Moms and dads can acquire considerable coverage for an inexpensive, and if the insured dies while the plan is in impact, the household can rely upon the survivor benefit to change lost earnings. These plans are also appropriate for people with expanding households.

What is the Advantage of Level Term Life Insurance Definition?

Term life plans are suitable for individuals who want substantial insurance coverage at a reduced cost. Individuals that possess whole life insurance policy pay much more in premiums for much less insurance coverage but have the safety of recognizing they are secured for life.

The conversion rider must permit you to transform to any permanent plan the insurance provider offers without constraints. The main functions of the motorcyclist are maintaining the initial wellness rating of the term policy upon conversion (also if you later on have health issues or become uninsurable) and determining when and just how much of the coverage to transform.

Certainly, total costs will certainly enhance significantly considering that entire life insurance policy is extra pricey than term life insurance policy. The benefit is the assured authorization without a medical test. Clinical problems that develop during the term life period can not cause costs to be boosted. The firm may require limited or full underwriting if you want to add additional cyclists to the new policy, such as a lasting care motorcyclist.

The Ultimate Guide: What is Level Term Life Insurance Policy?

Whole life insurance policy comes with significantly higher regular monthly costs. It is indicated to offer protection for as long as you live.

It depends upon their age. Insurance provider established an optimum age limitation for term life insurance policies. This is generally 80 to 90 years of ages but may be higher or reduced depending on the company. The premium likewise rises with age, so a person aged 60 or 70 will pay considerably more than somebody decades younger.

Term life is somewhat comparable to vehicle insurance. It's statistically not likely that you'll need it, and the costs are money away if you do not. But if the most awful takes place, your family members will obtain the benefits (What does level term life insurance mean).

Everything You Need to Know About 30-year Level Term Life Insurance

Generally, there are 2 sorts of life insurance plans - either term or long-term strategies or some combination of both. Life insurers supply various forms of term plans and conventional life plans along with "interest sensitive" items which have come to be extra prevalent considering that the 1980's.

Term insurance offers defense for a given time period. This duration can be as brief as one year or supply coverage for a specific variety of years such as 5, 10, 20 years or to a specified age such as 80 or in many cases as much as the oldest age in the life insurance policy mortality.

What Makes What Is A Level Term Life Insurance Policy Unique?

Presently term insurance policy rates are very competitive and amongst the most affordable historically experienced. It must be noted that it is a widely held idea that term insurance coverage is the least costly pure life insurance policy protection offered. One needs to review the plan terms meticulously to determine which term life choices are appropriate to meet your certain situations.

With each new term the premium is enhanced. The right to restore the plan without proof of insurability is an essential advantage to you. Or else, the risk you take is that your wellness might weaken and you may be not able to acquire a policy at the very same prices or also in all, leaving you and your beneficiaries without protection.

The length of the conversion period will vary depending on the type of term policy purchased. The premium price you pay on conversion is typically based on your "present obtained age", which is your age on the conversion date.

Under a level term policy the face quantity of the plan stays the exact same for the whole duration. Commonly such plans are marketed as mortgage protection with the amount of insurance coverage reducing as the balance of the mortgage lowers.

Typically, insurance firms have actually not had the right to change premiums after the policy is offered. Because such plans might continue for several years, insurance providers have to make use of conservative death, interest and expenditure price estimates in the costs estimation. Adjustable costs insurance policy, nonetheless, permits insurers to provide insurance coverage at lower "existing" premiums based upon less conservative presumptions with the right to alter these costs in the future.

Is What Is A Level Term Life Insurance Policy the Right Choice for You?

While term insurance is made to offer defense for a specified period, permanent insurance coverage is made to offer insurance coverage for your entire life time. To keep the costs price degree, the costs at the younger ages surpasses the real expense of defense. This additional premium develops a get (cash worth) which helps pay for the policy in later years as the expense of security surges above the premium.

The insurance firm spends the excess costs dollars This kind of policy, which is in some cases called cash money worth life insurance, produces a financial savings aspect. Money worths are important to a permanent life insurance plan.

In some cases, there is no correlation between the size of the money worth and the premiums paid. It is the cash value of the plan that can be accessed while the insurance holder lives. The Commissioners 1980 Requirement Ordinary Death Table (CSO) is the present table used in computing minimal nonforfeiture worths and policy gets for average life insurance policy plans.

Why You Should Consider Term Life Insurance With Level Premiums

Numerous irreversible plans will include provisions, which define these tax requirements. Standard whole life plans are based upon long-lasting price quotes of cost, passion and death.

Table of Contents

- – What is the Advantage of Level Term Life Insur...

- – The Ultimate Guide: What is Level Term Life In...

- – Everything You Need to Know About 30-year Lev...

- – What Makes What Is A Level Term Life Insuranc...

- – Is What Is A Level Term Life Insurance Polic...

- – Why You Should Consider Term Life Insurance ...

Latest Posts

State Farm Final Expense Insurance

Funeral Advantage For Seniors

United Funeral Directors Benefit Life Insurance Co

More

Latest Posts

State Farm Final Expense Insurance

Funeral Advantage For Seniors

United Funeral Directors Benefit Life Insurance Co